Value Creation in Vegas

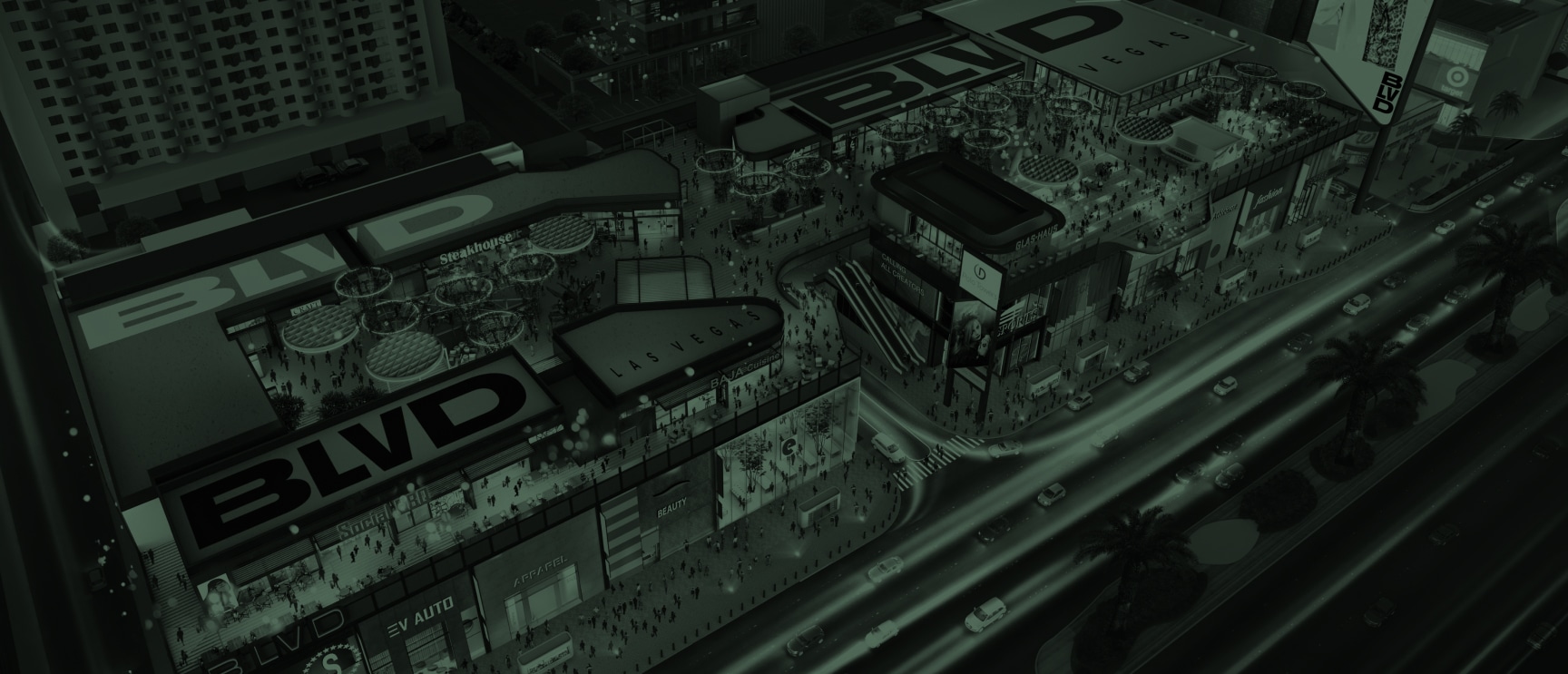

Gindi Capital’s acquisition and development of the Showcase Portfolio on the Las Vegas Strip is a prime example of strategic investment, leveraging strong partnerships and relationships to create a premier retail and entertainment hub featuring over 1,300 feet of linear frontage on the Strip. Over nearly a decade, Gindi Capital executed a phased acquisition and redevelopment strategy, transforming underutilized properties into over 500,000 square feet of high-performing assets.

THE VISION

Recognizing the Potential

When Gindi Capital identified the Showcase properties, they saw what many others overlooked—a prime retail location with untapped potential. The Las Vegas Strip attracts over 40 million tourists annually, and the site’s visibility and foot traffic resembled an opportunity akin to New York’s Times Square in the 1970s. The challenge was repositioning the properties to maximize their value.

STRATEGIC ACQUISITION & FINANCING

Building the Portfolio

Gindi Capital executed a phased acquisition strategy, purchasing the four existing adjacent retail parcels that makeup Showcase between 2014 and 2017. Bringing together financing for a portfolio of this scale required a combination of private equity, institutional investors, and strategic partnerships.

By securing capital through trusted partners, Gindi Capital ensured it could make bold moves—such as acquiring properties with low initial income but high potential for repositioning.

REPOSITIONING & DEVELOPMENT

Unlocking Value

With control over the properties, Gindi Capital implemented a comprehensive redevelopment plan:

- ● Tenant Upgrades: Replacing low-quality tenants with flagship national brands.

- ● Property Enhancements: Modernizing storefronts, improving signage, and increasing accessibility.

- ● New Construction: Developing a state-of-the-art retail building at 3767 S Las Vegas Blvd, featuring first-to-market tenants.

This repositioning transformed Showcase from a mix of high-performing and underperforming tenants into a cohesive, high-value retail destination, doubling net operating income.

THE ROLE OF RELATIONSHIPS

A Key to Success

Beyond financing, Gindi Capital’s network played a pivotal role in deal execution, and partnerships with key tenants such as M&M’S and Coca-Cola strengthened Showcase’s positioning on the Strip.

A Blueprint for High-traffic Retail Development

Gindi Capital’s Showcase Portfolio is a masterclass in real estate investment strategy. By identifying hidden value, securing strategic financing, and leveraging relationships, they transformed an underutilized retail corridor into a premier destination. The success of Showcase, unlocking over 1 billion in value, not only strengthened Gindi Capital’s reputation but also laid the foundation for continued development on the Las Vegas Strip.

Through vision, financial ingenuity, and strong partnerships, Showcase stands as a testament to Gindi Capital’s ability to redefine urban retail landscapes.